Investors Repeat the Same Mistakes

In mid-2022, the dominant market narrative was clear: a global recession was looming. Yield curves inverted. Fear permeated headlines. Fund flows showed investors retreating from equities and rushing to cash. But then, in classic market fashion, reality unfolded in a way few expected. The pessimism marked a turning point. Equity markets rebounded sharply, and 2023 turned out to be a strong year. The MSCI All Country World Index (ACWI) delivered a stellar +22.2% return—recovering dramatically from its -18.4% drop in 2022.

Yet, for all the history and data available, many investors failed to learn the lesson.

We react to expectations

We have seen this play out repeatedly. Consider the “Tariff Tantrums,” or the U.S. strike on Iran. The prevailing expectation? Trouble ahead. Investors, sensing danger, de-risked. Exiting equities in favour of cash. At the time, it felt like the prudent move.

But reality does not ask for permission

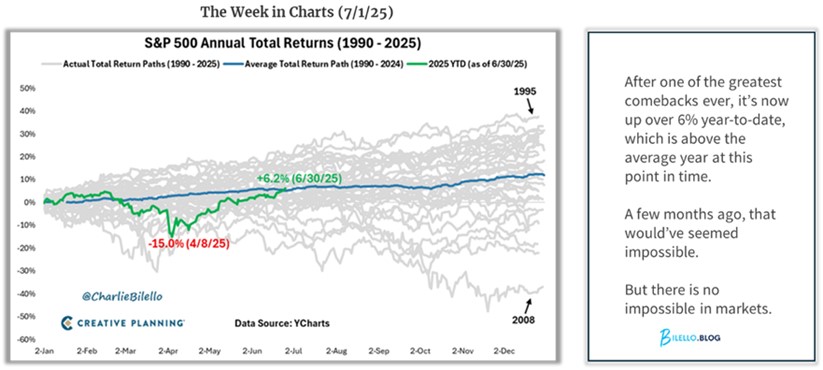

Instead, markets confounded the crowd. The S&P 500 rose by 3.5%, while crude oil prices dropped by 12%. After logging one of the worst starts to a year—down 15.3% in the first 66 trading days—the S&P 500 mean-reverted back toward its long-term average.

Those who reacted emotionally to the news cycle got hurt. Again.

Seth Godin recently captured this dynamic well. We all live inside our own narratives – our personal versions of reality. But our stories do not represent reality. As he writes: “Reality doesn’t mind showing up when we least want it to. Gravity isn’t just a good idea, it’s the law.”

Charlie Bilello offered more real-world context: “The S&P 500 rallied 28% off the April lows to hit its first all-time high since February 2020. The 64% decline in the VIX over the last 12 weeks marks the largest collapse in volatility in history.”

The pattern repeats

In early 2025 investors pulled capital from International Equities and piled into U.S. Equities, perfectly mistiming the rotation. International markets outperformed U.S. markets by 11%. A fact only realized after the shift. By May, investors had started moving out of U.S. equities. Too late – repeating the “sell low, buy high” cycle.

Why we keep getting it wrong

Volatility affects our behaviour. Being human means feeling discomfort in the face of uncertainty. To cope, we construct stories that help us make sense of what we think is happening. But those stories often mislead us, especially when they are motivated by fear and the desire for control.

Despite overwhelming evidence that market timing is a losing game, many investors continue to focus their time and energy trying to predict the unpredictable. In doing so, they make poor decisions often timed to perfection.

Let go of the illusion of control

Markets do not conform to our expectations. It is not beholden to our consensus. Trying to outguess this complex, changing system is both exhausting and counterproductive.

Recognize your own limitations. Let go of the need to control the uncontrollable. Shift your focus from prediction to preparation, from short-term noise to long-term alignment with your values and goals.

We may be human, but we are not helpless. Awareness is the first step to breaking the cycle.

The above article was written by Marius Kilian.

Source

* “The Week in Charts (7/1/25)”, Charlie Bilello, bilello.blog, 1 July 2025.

* “US stock market: Key questions as second half of 2025 kicks off”, Lewis Krauskopf, www.reuters.com, 1 July 2025.