Is HALE the New Standard for Retirement Planning?

For decades, retirement planning has revolved around one central variable: “how long you’re likely to live”. Life expectancy tables, actuarial assumptions, and longevity projections have formed the basis of financial models. But as our understanding of health, aging, and human wellbeing evolves, a simple measure of lifespan is no longer sufficient.

A new standard is emerging. One that acknowledges a truth we all intuitively know yet rarely plan for: longevity does not mean vitality. And this new standard is called Health-Adjusted Life Expectancy (HALE).

What Is HALE—and Why Does It Matter?

Health-adjusted life expectancy (HALE) combines how long you are likely to live with how well you are likely to live during those years. It incorporates both mortality and health status, estimating the average number of years a person can expect to live in full health.

Instead of treating all years of life as equal, HALE distinguishes between:

- Years lived in good health, and

- Years lived with illness, disability, or reduced functioning.

HALE brings quality into the conversation, not just quantity. Your financial plan should align not only with “how long” you live, but with “how you live”.

The Longevity Trap

Modern medicine is extending the number of years we live. But modern lifestyles—sedentary work, chronic stress, processed foods, digital overload—are causing us to experience disease and functional decline earlier.

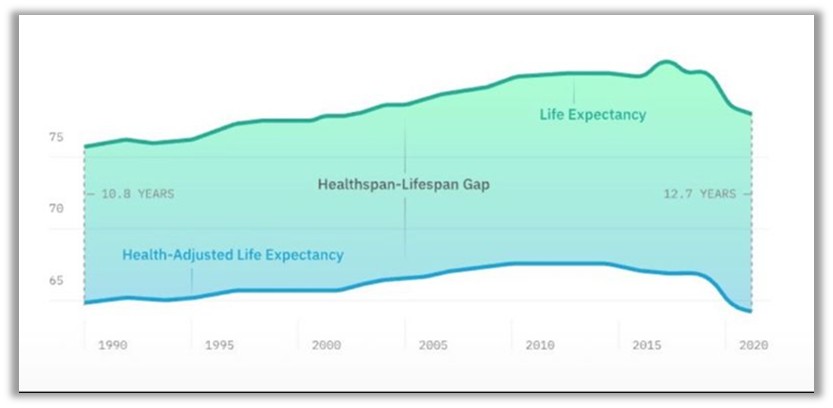

As a result, the gap between lifespan and healthspan is widening.

In his LinkedIn post “We’re Not Living Longer… We’re Dying Slower,” Dan Haylett captured the reality succinctly:

“Over the last 30 years, lifespan has gone up, but healthspan (the years lived in good health) hasn’t kept pace. In fact, the gap between them keeps growing.”

That gap, the years we live in poor health, has widened to an average of 10–12 years in most developed nations.

This is the paradox of modern aging:

We are adding years to life… but not necessarily adding life to years.

For individuals, this raises difficult questions:

- What is the value of longevity if more of it is spent unwell?

- How do we plan financially when the final decade(s) of life may be consumed by preventable decline or rising healthcare needs?

- How do we ensure wellbeing, independence, and dignity through those years?

This is where HALE changes the conversation.

Why HALE Must Become the New Retirement Planning Standard

- It aligns planning with actual lived experience.

Traditional retirement planning assumes a smooth, linear aging process. But real life is messy. Chronic illness, cognitive decline, functional limitations, and lifestyle-driven diseases alter the trajectory—often decades before death. HALE gives us a more accurate picture of what “later life” actually looks like.

- It reframes the purpose of wealth.

The goal is not simply to fund a long life. The goal is to fund a high-quality life. When clients see the difference between their “lifespan line” and their “healthspan line,” the purpose of financial planning becomes clearer: protecting the years when they are most able to enjoy life.

- It integrates health, lifestyle, and behaviour into financial strategy.

Your health choices today shape your financial needs tomorrow. Your financial choices today shape your ability to remain healthy tomorrow. HALE makes it possible to discuss nutrition, stress, activity levels, and mental wellbeing as financial planning variables, not mere side notes.

- It highlights the true cost of ignoring health.

A longer life lived predominantly in ill health results in:

- Higher healthcare expenditure

- Increased dependence on others

- Reduced autonomy

- Lower life satisfaction

- Greater financial strain on family systems

When clients understand HALE, they see that investing in health is a financial strategy, not a luxury.

From Retirement Planning to Healthspan Planning

Vitality comes into the conversation.

Healthspan planning asks different questions:

- How do I extend the number of healthy, active years I have?

- How do I plan financially for the years when my health may decline?

- How do I structure my wealth to support physical, emotional, and cognitive wellbeing, not just survival?

- How do my current behaviours impact my future financial risks?

The inclusion of HALE transforms financial planning into a more honest and realistic exercise.

Adding years to your life means nothing if you are not adding life to your years.

Written by Marius Kilian

Sources:

* “Were-not-living-longer-were-dying-slower’, Dan Haylett, linkedin.com/posts/dan-haylett-retirement-coach.