Compounding, Time, and Becoming a Lifetime Investor

The power of time and compounding can significantly enhance the odds of success for long-term investors. Unfortunately, many investors fail to build their investment plans on these strong foundations, leading to a disconnect between the potential of compounding and the behaviour of the average investor.

Understanding the Magic of Compounding

Understanding the Magic of Compounding

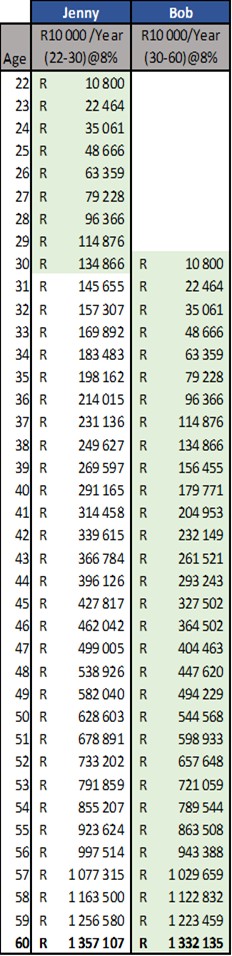

Compounding is a remarkable phenomenon that can exponentially grow your wealth. It involves generating additional earnings from the initial earnings on your assets over time, often referred to as the snowball effect. To grasp the power of compounding, let’s consider a hypothetical example involving two investors: Jenny and Bob.

Jenny initiates her investment program early, starting from the age of 22. She invests R10,000 at the beginning of each calendar year until the age of 30, totalling R90,000. She then allows her money to grow untouched until age 60.

On the other hand, Bob begins his annual R10,000 investments at the age of 30 and continues until he reaches 60, resulting in 30 payments totalling R300,000. Both investors achieve an average annual return of 8%.

Surprisingly, when comparing the end value of their investments, Jenny’s surpasses Bob’s by R24,971 (R1,357,107 vs. R1,332,135), despite Bob making more than three times the contributions.

The Counterintuitive Nature of Compounding

The concept of compounding may not feel intuitive to the human mind, as we tend to think linearly rather than exponentially. We struggle to grasp the significance of small, continuous habits that can profoundly impact our lives. For instance, taking 10 linear steps results in being 10 steps away, while taking 10 exponential steps (doubling the distance with each step) places you over 1,000 steps away. This discrepancy between linear and exponential growth hinders our ability to fully appreciate the true power of compounding.

Despite its counterintuitive nature, compounding remains a crucial force for long-term wealth creation. Becoming aware of its potential is essential for becoming a better lifetime investor.

Learning from Warren Buffet

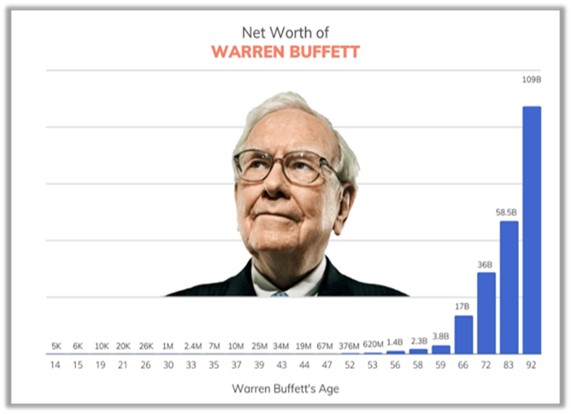

Warren Buffet, one of the most quoted investors in history, exemplifies the power of compounding through his immense wealth. At the age of 92, his estimated net worth is $114 billion, making him the 6th richest person in the world. However, what contributed significantly to his wealth is often misunderstood and overlooked.

Buffet only became a billionaire at the age of 56, with 99% of his net worth being earned after his 50th birthday. He started investing at the age of 11 and amassed a net worth of $1 million by age 30 (approximately $9 million in today’s terms).

An intriguing thought experiment by Morgan Housel, titled “The Freakishly Strong Base,” explores what would have happened if Buffet had started investing at age 22 instead of 11. The results indicate that his net worth would have been $24,000 (adjusted for inflation) by the age of 30. Applying the same returns, Buffet’s net worth would have been $1.9 billion, representing a staggering difference of 97.6% compared to his actual net worth of $81 billion in 2017 when the article was published.

Morgan Housel observes: “How can most of Buffett’s success be attributed to what he did as a teenager? It’s so crazy, so counterintuitive. And since it’s crazy and counterintuitive we overlook the right lessons.”

The key lesson to draw from Buffet’s success is the importance of behaviour and discipline from an early age. His success can be attributed to the foundation he laid in his teens and the power of compounding over time.

Embracing Compounding for Lifetime Investing

To become a successful lifetime investor, it is crucial to pay attention to the small, disciplined steps that lead to outsized results over time. The magic happens when time and good behaviour are combined with the powerful force of compounding.

By starting early, being consistent, and letting time work in your favour, you can harness the true potential of compounding and pave the way for significant wealth creation in the long run.

“While not at the forefront of investors’ minds or the news headlines, it’s compounding that stands as a silent hero within one’s investment portfolio.” – Justin Carbonneau

The above article was written and adapted by Marius Kilian.

Sources

*“The freakishly Strong Base”, Morgan Housel, collabfund.com/blog, 31 Oct 2017

*“Compounding: The Silent Hero in Your Investment Portfolio”, Justin Carbonneau, blog.validea.com, July 2023