Goals, Resolutions and the Lack of Follow Through

Every year we start with good intentions and New Year’s resolutions. However, research suggests that fewer than 25% of us follow through on these intentions. Weight loss is a common example – we intuitively know what to do but don’t do it.

The path to successful weight loss is uncomplicated: eliminate certain foods, establish a basic exercise routine, practice patience, and transform these actions into lifestyle habits. Failure isn’t typically due to a lack of knowledge but rather a lack of consistent behavioural alignment with this knowledge.

Similar challenges exist in the realm of long-term investing. If you have clarity on what’s important to you, you will be able to set feasible future goals. What you need to do to achieve long-term success is similarly also not complex.

The basics for investment success – what you need to do.

- Increase your income.

- Decrease your spending.

- Invest in income-producing assets.

- Keep investing through all market cycles.

- Maintain a diversified portfolio.

- Prefer simplicity over complexity.

- Avoid interrupting the compounding effect.

- Behave – align your actions with your values.

Despite the simplicity of these principles, the real challenge lies in execution. Understanding what needs to be done is not enough; the critical factor is consistently translating knowledge into action.

The challenge is not in the “knowing” but rather in the “doing”.

Observed behaviour – what investors do.

- Most of us believe we are “above average” both in understanding and entitlement.

- Research confirms that investors earn lower returns than the actual return of the funds they were invested in due to mistiming and withdrawals.

- Investors start with a long-term goal in mind but often shift their focus to short-term relative performance.

- Investors are deeply affected by market movements in the short-term and abort their long-term strategy for comfort.

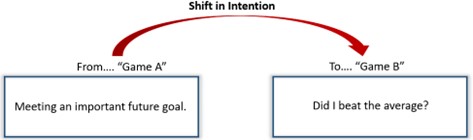

- A shift in intention is evident in investor behaviour.

These are two very different intentions and games at play. Falling for the “grass is greener fallacy,” we often sell out of our “long-term positions” in favour of the recent short-term performers. You need a different mindset and gameplan to achieve these two very different desired outcomes.

Having and adhering to a trusted investment process for the long-term game offers a higher probability of success. Conversely, consistently outperforming the “average” in the short term is improbable and often leads to long-term disappointment.

Ultimately, success lies in behavioural patterns, not just knowledge. “Knowing better” serves little purpose if it does not result in “doing better”.

“Stop searching for the best investment and, instead, focus on being the best investor”. – Carl Richards

The only game that is important and that you need to win is the long-term game: having the funds available when you need it.

The most reliable “alpha” in the investment world is behavioural alpha. Alpha is a measure of performance. It represents the excess return of an investment relative to the return of a benchmark index.

The “index” that matters is not the market but rather the behaviour of the average investor.

The problem is not the plan or the market over the long-term. It is the investor’s behaviour.

The above article was written and adapted by Marius Kilian.