How will AI impact the future of Financial Advice?

The hype is real! Machines with human level intelligence seems to be with us.

Artificial Intelligence (AI) solves problems that require the kind of reasoning that we associate with human intelligence. AI learns from past processes and goes beyond normal algorithms which are formulas for processing data. It has the ability to learn. The software can answer virtually any question in a conversational way, keep track of what a user said earlier on in the conversation and answer follow-up questions.

ChatGPT was launched in November 2022 and is causing quite a stir. Due to legitimate concerns, it is not universally well-received. Opinions are polarised an many people fear a dystopian future for which we are not prepared. Technological innovations are disruptive by nature and can lead to displacement and redundancies as the adoption thereof increases.

Within 4 months of launching ChatGPT in November 2022 the next iteration ChatGPT-4 is now available with enhanced capacity that exhibits human-level performance. Progress is never linear but happens on an exponential curve. We are continually surprised by this.

This technology strongly pushes into the knowledge worker’s space. As AI becomes economically viable it will replace an increased share of the work currently being done by humans. Not all jobs are equally vulnerable. It seems that IQ related jobs that are rules based and follow a particular logic are most vulnerable. EQ related jobs with a strong human element are less vulnerable.

“Jobs that emphasize interpersonal skills are much harder to be replaced by an AI” – Prof Dimitris Papanikloaou (Northwestern University)

Where do you spend your time?

Most jobs will be impacted by AI but not necessarily become redundant. AI will be used to augment the work of humans to help them do their jobs more effectively. The upside is that it will make companies more efficient. This will require us to reskill and upskill ourselves and our workers. Repetitive analytical work and anything that falls in the “doing space” is at risk.

Despite the fears, every technological advance historically ended up creating more jobs than were destroyed. What makes AI a bit different is that it impacts virtually all industries. Middle skill jobs are the most at risk. We simply need to adapt and prepare ourselves by re-skilling ourselves.

Our education system is probably not geared for this new reality as it still focusses on academic areas that relate to IQ skills. AI will probably out-read, out-math, and out-write us unless we are the creators of truly original thought and content.

The human side of advice

Humans cannot compete with the speed at which AI gives feedback. AI cannot compete with the soft skills of a human advisor. Empathy and EQ (Emotional Intelligence) requires us to experience emotions. Emotions are critical for good decision making. The financial advice process requires communication and listening skills. Compassion and empathy are uniquely human.

While AI and automation may eliminate the need for humans to do any of the doing, we will still need humans to determine what to do.

Don’t despair, rather prepare

There’s no doubt that the AI revolution will require re-adjustments for what is to come. Don’t adopt a “man-vs-machine” mindset, but rather think “man-and-machine” augmentation.

Technical skills will be less important than creative skills. “How” will matter less than “Why”. Everything that relies on knowledge and logical agility is at risk. Human intuition will be more difficult to replace.

The level of personalisation that results from a thoughtful process of questions and answers between advisor and client cannot be replicated yet. A trusted advisor relationship goes beyond the crafting of a plan. Helping clients to follow through and stick to the plan when they are behaviourally challenged to do so is the true value of advice.

AI can help you with the “what questions” not the “why questions”

AI responds to the questions that you ask and provide information and feedback based on it. The quality of the output is dependent on the quality of the questions. It does not have the ability to ask deeper probing questions to get to your true values and priorities. It does not help you to find “Why” something is important to you. Asking better questions and listening with empathy is a uniquely human trait.

Human conversations will lead to greater awareness and clarity. AI is not an accountability partner that checks in regularly to see if anything changed in your life or finances. AI will never get to know you.

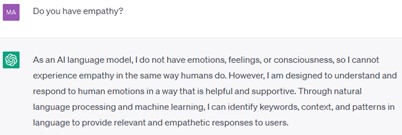

By its own account ChatGPT does not have EQ or empathy when asked the question:

ChatGPT can provide the basic rules and pointers, but for proper planning, a human advisor will be needed. Building and maintaining trusted relationships in the experience economy is still a uniquely human endeavour.

EQ that combines with AI will be a powerful combination.

The above article was written and adapted by Marius Kilian.

Sources:

*https://openai.com/research/gpt-4

*“ChatGPT sets record for fastest-growing user base”, Krystal Hu, Feb 2023, Reuters.com

*“The Impact of Artificial Intelligence – Widespread Job Losses”, Calum McClelland, January 2023, iotforall.com

*“ChatGPT helped me make a plan to buy a $500,000 home, but experts warn about using AI for financial advice”, Ivana Pino, March 2023, Fortune.com