A Controversial Take - It is Better to Optimise for Behaviour than for Return

Most investors know they cannot successfully time the markets with any consistency. It is widely accepted that to increase the odds of investment success you need stick to a well-defined plan and strategy over time allowing compounding to work its magic.

However, despite this knowledge, evidence suggests that many investors struggle to align their behaviour with these principles, leading to suboptimal outcomes.

It is not bad markets that derail thoughtful investment plans. It usually comes down to poor investor behaviour.

Market turmoil and fear often change our investment posture, skewing our perception of risk and leading to irrational investment choices. Managing one’s emotions, therefore, becomes a critical component of successful investing, perhaps even more so than managing the investment portfolio itself, as noted by Ben Carlson.

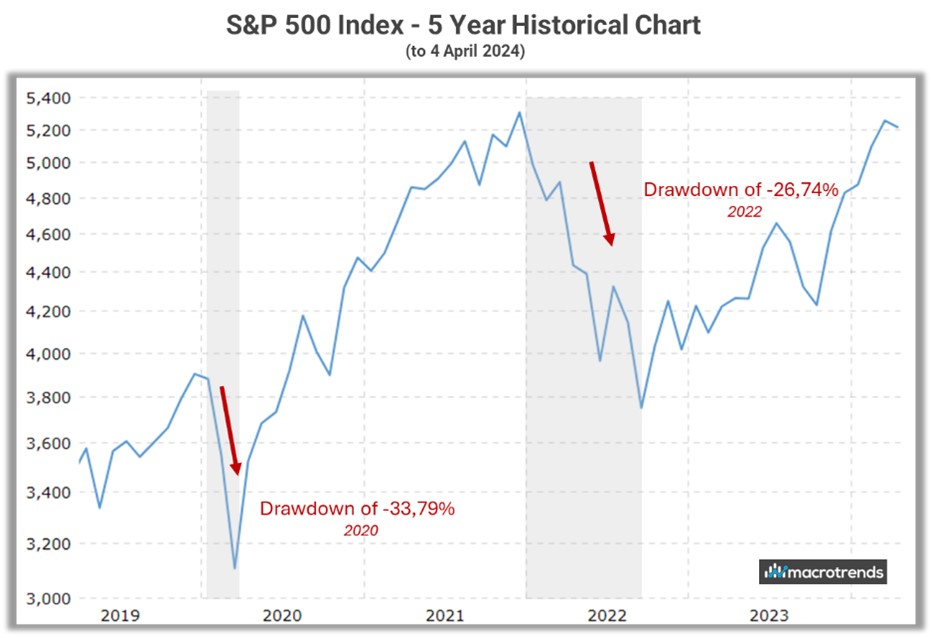

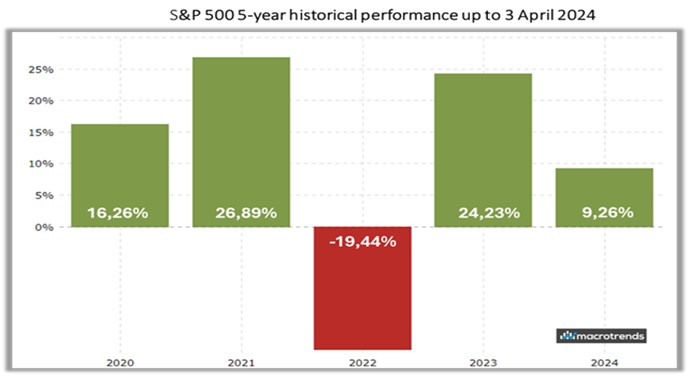

Consider what the average investor had to endure the past 5 years when we consider the S&P500 index.

For instance, in March 2020, during the COVID-19 pandemic, the S&P 500 experienced a significant decline of -33.8%. In 2022, there was another notable drawdown of 26.7%, with the market ending the year with a negative return of -19.4%. Inflation surged, and even bonds suffered, making the past five years particularly volatile for investors.

Despite predictions of a global recession and severe market downturns for 2023, the markets defied expectations, as shown in the graph below. This underscores the unpredictability of markets and the importance of not succumbing to consensus narratives.

The annualized return of the S&P 500 over the past five years, from 30 April 2019 to 31 March 2024 was 15.5%, with a cumulative return of 101.6%. This highlights the importance of maintaining a patient and disciplined approach to investing, even in the face of market volatility and uncertainty.

Successful investors are distinguished by their ability to deal with losses. The suboptimal strategy you can stick with is far superior to the optimized strategy you can’t stick with. “All of us would be better investors,” Daniel Kahneman often said, “if we just made fewer decisions.”

By understanding your emotions and implementing strategies to keep them in check, you can make more informed and rational financial decisions, ultimately leading to greater long-term financial success.

When you zoom in: The “This time it’s different” narrative will unleash all your behavioural biases.

When you zoom out: The “This too shall pass” narrative will allow you to maintain perspective.

“Constantly predicting the end times might help you gain subscribers, but it doesn’t help people make money”, says Ben Carlson.

The worst thing that you can do is to reset your long-term strategy during a perceived crisis. What feels emotionally right in the short term has proven to be rationally wrong in the long-term.

Awareness of your own behavioural limitations is critical. You can only bring intention to what you are aware of. Because this awareness is highly subjective and personal, a good financial advisor is ideally suited to help ensure commitment to this life-long practise.

The above article was written and adapted by Marius Kilian.

Source

* “The Most Important Concept in Finance”, Ben Carlson, awealthofcommonsense.com, 24 March 2024

* www.macrotrends.net