Persistence Score Card: Fund Performance vs. Investor Behaviour

Even when we are warned, we still don’t act rationally and in our own best interest.

The phrase “past performance is no guarantee of future results” is communicated to investment clients as financial advisors are compelled to disclose this from a regulatory perspective.

Our collective behaviour evidences the exact opposite of what was intended by this health warning. We predictably default to conversations that are dominated by past performance metrics that ultimately guide decisions on fund selection.

The past performance information can only be useful if there is material persistence in past performance signalling that it was the result of skill rather than luck.

Can we manage the evidence that our collective focus on past performance is productive in any way?

This question is addressed by the S&P Dow Jones Indices in their “US Persistence Scorecard Year-End 2022” report.

“The data confirmed that most top-performing fund managers rarely stay on top. And that we find very little evidence of persistent active management success.”

The evidence

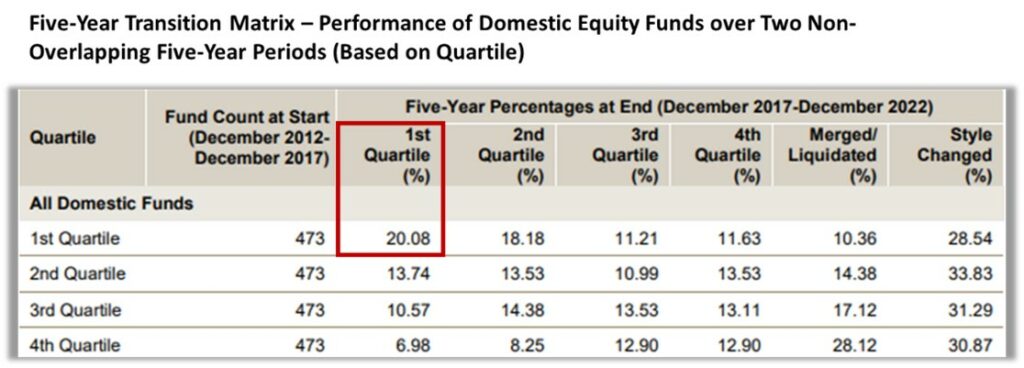

In the table below the 1st quartile funds is based on a defined 5-year performance period (Dec 2012 to Dec 2017). In the subsequent 5-year period only 20.08% of those funds remained in the top quartile.

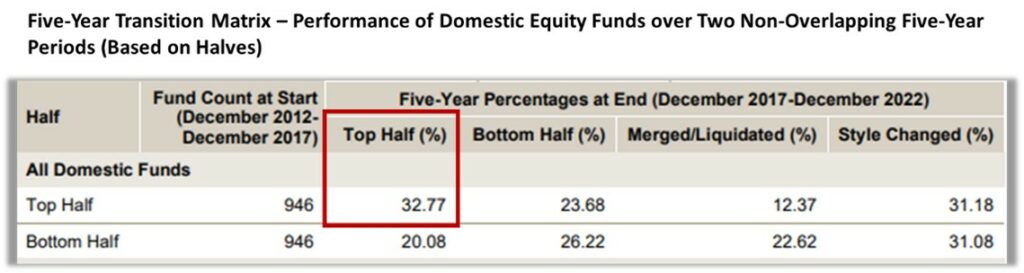

Following a similar approach (table below), the funds were then also measured in terms of halves: top 50% vs. bottom 50%. Only 32.77% of the funds remained in the top half after 5 years.

This is not a good “pass mark” to suggest any persistence in fund performance.

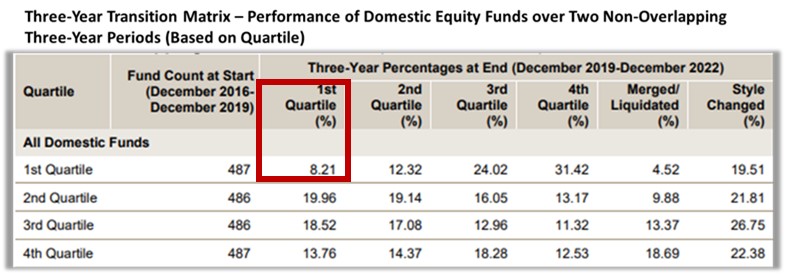

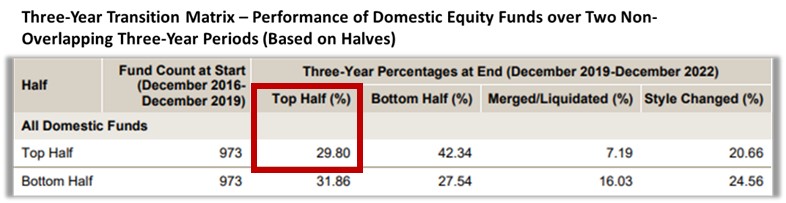

The average holding periods for these funds, based on experience, is actually closer to 3 years. This suggests that investors reconsider their fund selections over periods shorter than 5 years.

In the table below they measured fund performance over a 3-year period. We see that only 8.21% of 1st quartile funds remained in the top quartile after 3 years. Even worse, 31.4% of these funds dropped to the 4th quartile.

When measured in terms of halves rather than quartiles – we find that only 29.80% of funds remain in the top 50% after 3 years.

When we consider the evidence, we must admit that past performance factually is not a good indicator or predictor of future performance.

If only our conversations and behaviours reflected this realty it would result in better decision-making.

The Facts

We don’t find persistence solely based on considering historic fund performance.

We unfortunately do find persistence in sub-optimal investor behaviour.

The above article was written and adapted by Marius Kilian.

Source:

*www.spglobal.com/spdji/en/documents/spiva/persistence-scorecard-year-end-2022.pdf