There is no Market Forecaster Hall of Fame

If market forecasts worked, someone would have a consistent track record by now. They do not.

Every year, Wall Street produces a fresh set of market forecasts. Targets are published. Numbers are offered with high conviction. Every market cycle produces its prophets.

And every year, reality reminds us – often painfully – how little these predictions are worth.

This is not an opinion. It is what the evidence clearly shows. The only true consistency in forecasting is that it is an unreliable foundation for future decisions. Acting on them is a net negative activity that systematically destroys long-term returns.

If forecasting were a skill, we would see the same names outperforming over time, with a narrowing dispersion of errors and improving forecast accuracy with experience. We see none of that. Instead, we see a rotating cast of “experts” who are remembered for their best call and quietly excused for their many failures.

The scorecard no one likes to show

Over the 20-year period ending in 2024, the relationship between market forecasts and what “actually happened” was effectively non-existent. There was no meaningful correlation between what experts predicted and what markets delivered.

From 2000 to 2023, the median Wall Street forecast missed the market’s actual return by 13.8 percentage points per year. That error is more than double the market’s own long-term average annual return over the same period. Forecast accuracy was worse than a coin flip – about 47%, barely different from pure chance.

If you flipped a coin to decide whether forecasts would be “right” or “wrong,” you would not do meaningfully worse than the experts.

Forecasts are rarely useful

Consider what typically happens: When markets fall sharply fear dominates the headlines. It is usually at this point that forecasts are revised downward. History shows that this often precedes a market rebound.

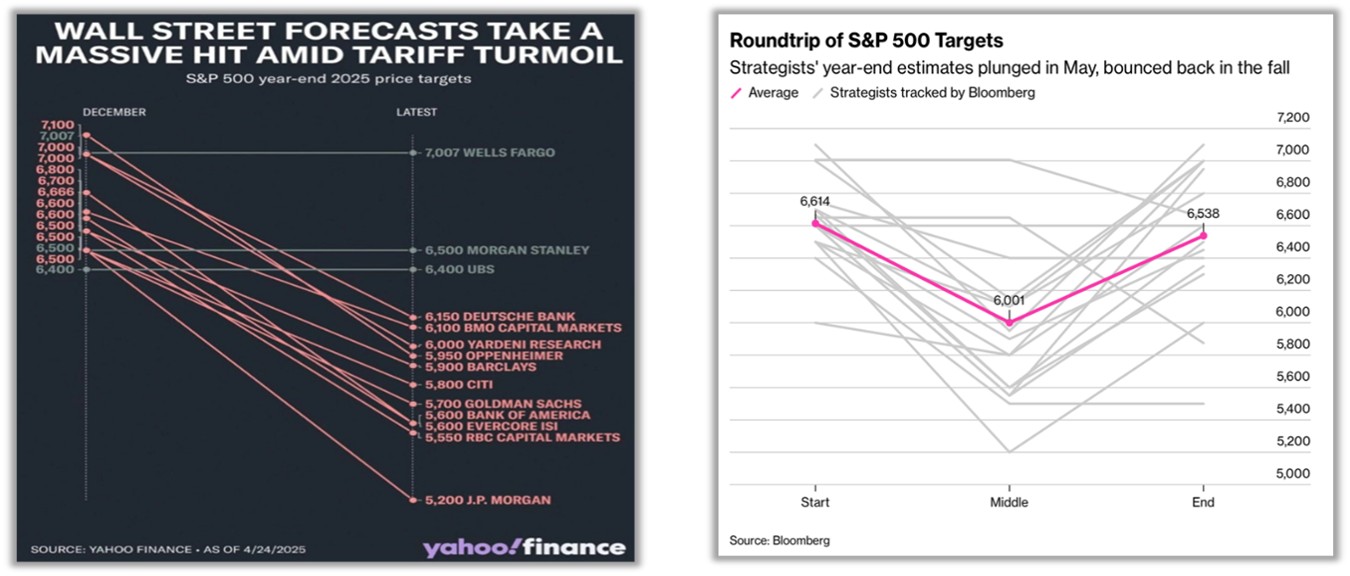

After President Trump’s April 2 “Liberation Day” tariff announcements, markets sold off sharply. Commentators warned of “something similar to 1987’s Black Monday”. Forecasts were slashed across the board.

That moment turned out to be the market bottom. From the April 8 lows, the S&P 500 went on to gain nearly 40% through year-end. As prices recovered, forecasts were revised upward again – just in time to explain what had already happened.

In the image below you see how the forecasters see-sawed on their predictions as reality unfolded – right on cue. This behaviour is consistent with historical experience.

This pattern repeats endlessly:

- Forecasts follow markets down.

- Forecasts follow markets up.

Forecasts as “weather vanes”

Market predictions increasingly resemble an economist staring at a “market vane”, not a compass.

They do not point to the future.

They spin with the trade winds of the day: inflation prints, headlines, sentiment, and recent returns. They capture mood and narratives – how things feel now – not reliable probabilities about what will happen next.

Planning makes sense. Prediction does not.

As John Stepek, author of The Sceptical Investor, puts it:

“You must accept that you can neither know the future, nor control it. The key to investing well is to make good decisions in the face of uncertainty… Making good decisions is mostly about putting distance between your gut and your investment choices.”

This distinction matters deeply. A good decision can lead to a bad short-term outcome. A bad decision can sometimes look good – briefly. But a series of good decisions, made consistently and calmly, tends to compound into better long-term outcomes.

Forecasting tempts us to do the opposite: to react, adjust, and override our process based on confidence that has not been earned.

Trust the evidence

The lesson of decades of failed forecasts is not that experts are foolish. It is that markets are not forecastable in a way that is consistently useful for investors.

The edge does not come from knowing what markets will do next. It comes from:

- designing portfolios that can survive many futures,

- setting rules that protect behaviour,

- and accepting uncertainty rather than fighting it.

For investors, preparation beats prediction.

Written by Marius Kilian

Sources:

* Do Financial Gurus Produce Reliable Forecasts? David H. Bailey, Jonathan M. Borwein, Amir Salehipour, and Marcos López de Prado (2018),

* “Forecasting follies2025”, Bob Seawright, betterletter.substack.com, 13 Jan 2026

* “Ten Lessons the Market Taught Us in 2025”, Larry Swedroe, larryswedroe.substack.com, 9 Jan 2026