We are often not as in control of our choices as we think

Every day, we make decisions that shape our future. When we make decisions there is an interplay between cognitive and emotional biases, which can profoundly impact the quality of our choices.

Our minds have two parts: one that thinks about things and another that feels emotions. These two parts work together in making decisions.

The dual nature of Cognitive and Emotional biases

Economic theory once assumed that humans would act rationally in their investment decisions. However, the realm of behavioural finance emerged as a branch of economics to explain our “predictably irrational” tendencies, particularly when it comes to investing. Our behaviours, often rooted in deeply ingrained biases, can inadvertently impede our potential for investment success.

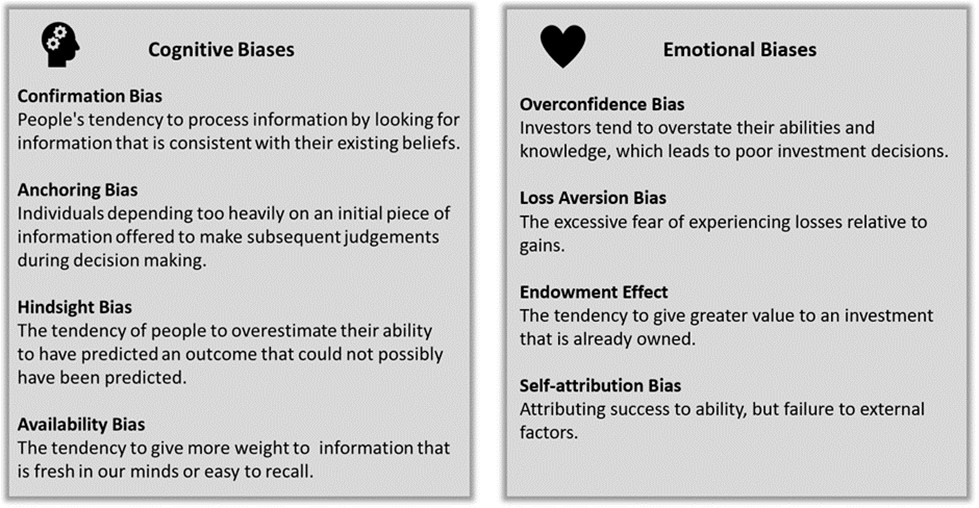

These biases can be broadly classified into cognitive (thinking) and emotional (feeling) biases, each characterized by distinct processes and influences.

Cognitive Biases: The constructed errors

These show up when our minds process information in a not-so-logical way. Cognitive biases stem from the intricacies of our thought processes. These biases manifest as deviations from rational decision-making norms, leading to errors in how we interpret information and statistics. Driven by subjective factors rather than objective evidence, cognitive biases are consciously constructed.

Emotional Biases: The subconscious sway

Conversely, emotional biases are the outcomes of the hidden currents beneath our conscious awareness. These biases arise from the sway of emotions, feelings, beliefs, and perceptions, culminating in sub-optimal decisions. These tendencies are accentuated under conditions of uncertainty, showcasing their predictive nature. Our emotional responses shape our perceptions, leading us to make decisions without a clear understanding of their underlying rationales.

Below is a couple of examples of these biases:

Mitigating the impact of these biases

So how can we make better choices with all these biases affecting the quality of our decisions?

Being aware that they exist is a big step.

Recognizing these biases enables us to navigate decision-making with greater clarity and accuracy. Having a better understanding of how our judgements are affected by these biases is crucial for making better and well-informed decisions. Counteracting these biases necessitates acknowledging their presence as intrinsic components of human decision-making.

Managing cognitive biases is an easier task than addressing emotional biases. Though they operate on different layers of consciousness, these biases often intertwine and influence one another.

Strategies to reduce the impact of these biases include dedicating time for reflection, embracing critical thinking, and actively seeking alternative perspectives. An invaluable guide on this journey is a trusted advisor who can hold your hand through the twists and turns of both investing and life.

Greater awareness of these biases will ensure that you are guided by reason rather than being hijacked by emotions or cognitive distortions. Greater awareness leads to better decisions which ultimately results in better outcomes.

Be mindful of the influence of human biases. Establish investment rules and disciplines to counteract their impact.

The above article was written and adapted by Marius Kilian.

Sources

*” Cognitive vs Emotional Biases – Investing Psychology!”, Aron Almeida, tradebrains.in, 17 dec 2020

* “Behavioural Investing”, brooksmacdonald.com, 29 March 2018