Align your Actions with your Timeframe

In May 1999 Barron’s published a cover story on Amazon shortly before the tech bubble burst.

In the article Jeff Bezos was rubbished as just another middleman and that the idea of him pioneering a new business paradigm was silly.

In the article Jeff Bezos was rubbished as just another middleman and that the idea of him pioneering a new business paradigm was silly.

We all know what has transpired over the following two decades. Bezos won over the long-term. But if you consider the short-term performance in the 16 months after the article ran, Barron’s was sort of right.

The tech bubble burst in May 2000 and Amazon eventually had a drawdown of -94%. As we also know, many IT stocks with less long-term viable business models, or more precarious short-term financing needs, never recovered. Looking back now everybody believes that the business model was obvious and a sure thing with the share price following suit.

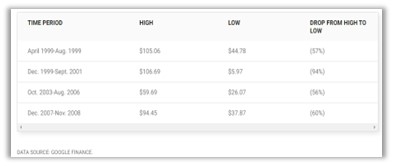

But you’d be hard-pressed to find anyone – outside of founder/CEO Jeff Bezos – who has been able to hold onto their shares for the entire ride. The stock has had its fair share of massive sell-offs. Consider what it would have been like – emotionally – to not sell during the periods in the graph below.

Investors that took a long-term view on the business fundamentals and the quality of the company’s management remained committed.

Investors that took a long-term view on the business fundamentals and the quality of the company’s management remained committed.

The average investor (the majority) did not have this mindset.

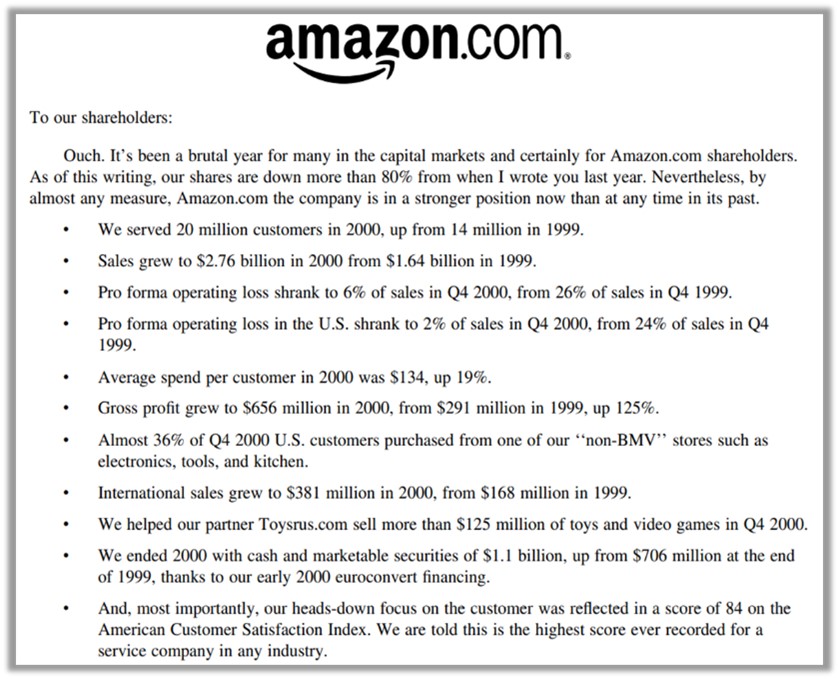

Below is an excerpt from Bezos’s letter to Amazon shareholders after the share price dropped by more than 80%. By all accounts the business had a great year but the share price still got hammered.

Based on the volatility of the markets and the incessant news flow from the media it is very difficult to remain a disciplined long-term investor.

Understanding your time frame and acting accordingly is the biggest determinant of your success as an investor.

The average investor underperforms the funds that they were invested in due to their lack of discipline and the frequency of their activities.

Fear takes the front seat when markets decline in the short-term and transforms long-term investors into short -term traders. Barron’s was right over the short-term, but dead wrong in the long-term. (Side note: over the last year Amazon is down -36% again.)

Be clear on your values and the process required for a high probability for success. Your timeframe is everything! Align your actions with your timeframe.

“The hardest part of the equation is not the math but the emotions. Having a long-term disposition will always give you an edge in the markets because it’s so difficult for others to think and act this way.” – Ben Carlson

The above article was written by Marius Kilian.

Sources:

* “Time horizon is everything for investors”, Ben Carlson, awealthofcommonsense.com, 14 October 2021

* “Amazon stocks history the importance of patience”, Brian Stoffel, www.fool.com, 19 July 2018