Short-term Sentiment, Confusion and Misguided Convictions

How much time do you spend agonising over short-term economic data?

Daily news flow is overwhelming and at times conflicting. As a long-term investor, to what extent does this inform or alter your long-term decisions?

Markets are always looking ahead and pricing in future expectations. If the consensus expectation is for a recession in the next 12 months, then the odds are good that it is already reflected in the market price.

The recession story is not a secret in the investing world. Short-term sentiment regarding what it means and how it will affect investors changes. Pinning your investment decisions on it is dangerous.

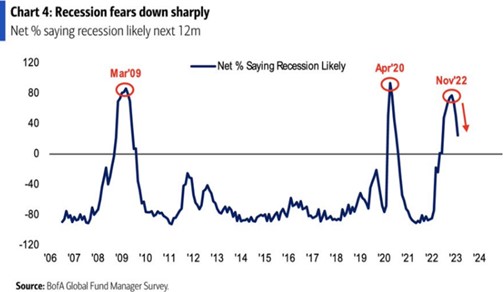

Data from a recent Bank of America Global Fund Manager Survey found forecasts of a recession had declined from a likelihood of 77% in November 2022 down to 24% in February 2023. This is quite a big revision in merely 3 months.

From 1 November 2022 to 23 February 2023 the S&P 500 has returned 5,97%.

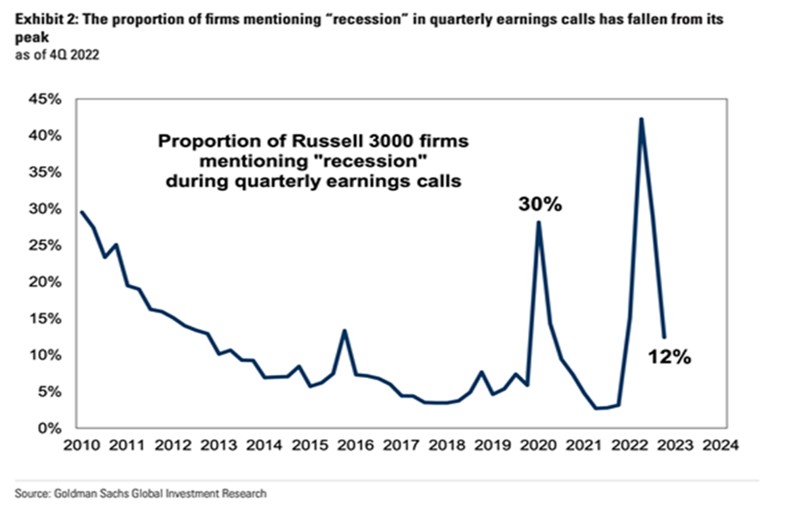

In support of the fund managers views above, Goldman Sachs research shows that the companies in the Russel 3000 index mentioning “recession” in their quarterly earnings calls has also declined significantly. The consensus view suggests that expectations have improved in the 3-month period.

What does this mean for the long-term investor?

Probably not much.

Long-term plans are structured with the knowledge that you earn the risk premium and excess returns that the market typically provides over time by accepting the volatility (up and down) that is normal and to be expected. From the outset one’s asset exposure should be diversified to suit your risk and return expectations.

The long-term investor knows that the bad days are baked into the process and that short-term news is a source of distraction. When we give too much attention to daily economic news our short-term actions end up being misaligned with our long-term motivations.

Even the Fed doesn’t get it right in the short-term.

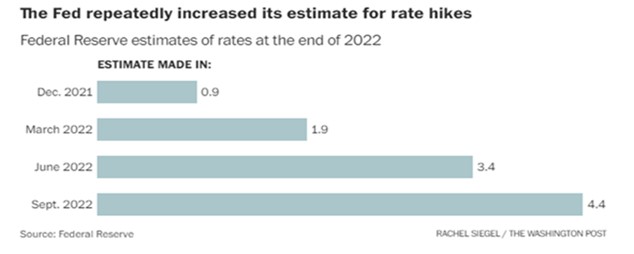

With the smartest people having access to the best research, we would expect greater accuracy than what their track record shows. At the beginning of 2022 the Federal Reserve expected raising interest rates 3 times ending at 0,9%. They revised this estimate every 3 months by quite some margin – see graph below:

In his last public remarks in December 2021, Federal Reserve Chair Jerome Powell offered a blunt message: “No one knows with any certainty where the economy will be a year or more from now.”

He was spot on. We should listen.

The above article was written by Marius Kilian.

Sources:

*“Economic forecasts are getting revised up, and people aren’t thrilled about it “, Sam Ro from TKer.

*“Fund managers and corporate executives have sharply reduced their recession expectations”, Anviska Patel, Market Watch, 14 Feb 23.

*“2022 shattered economic forecasts. Can the Fed get 2023 right? Rachel Siegel, Washington Post, 12 Dec 2022.