Beware Prevailing Investor Sentiment and Consensus

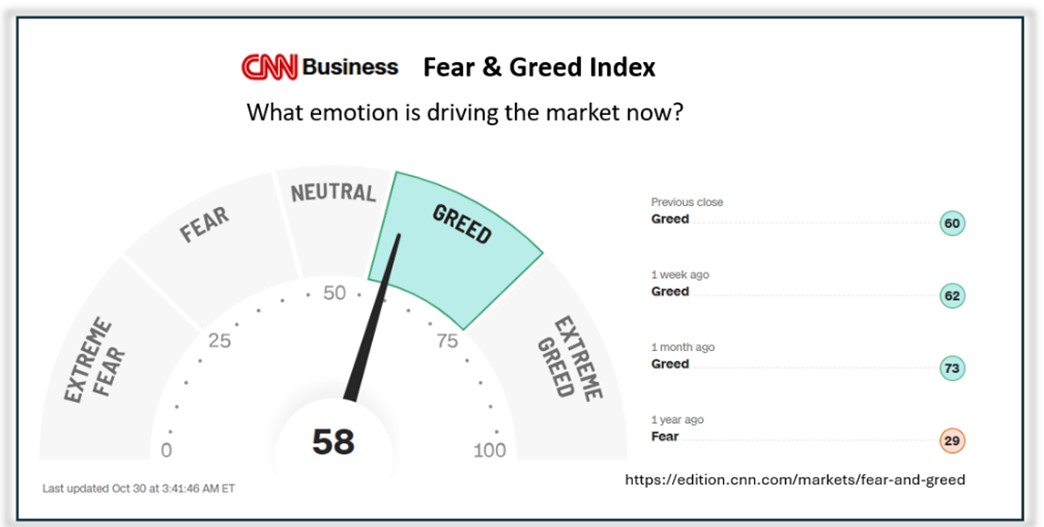

The CNN Business website offers a “Fear and Greed Index,” which tracks the prevailing emotions in the market. At present, the market sentiment falls within the “Greed zone.”

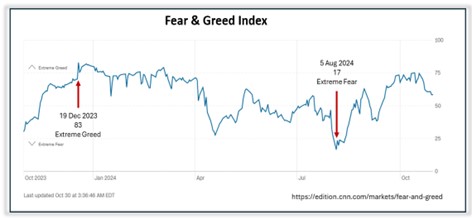

However, if we zoom out and assess how this sentiment has fluctuated over the past 12 months, it becomes clear that prevailing market emotions should not guide investment decisions. During this period, the market has swung between “Extreme Fear” and “Extreme Greed,” yet overall, it has performed well.

Sentiment and Consensus Are Often Wrong

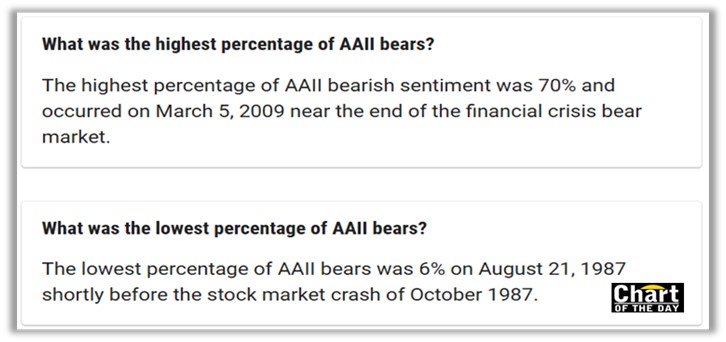

Investor sentiment and market consensus are frequently incorrect. In September 2022, after the market had fallen over 23%, Chartoftheday.com noted, “Investor sentiment refers to the average outlook investors have towards a particular market or security. Investors agree — more than 60% are bearish right now.”

Similarly, in October 2022, the prevailing media outlook was overwhelmingly negative, with predictions that 2023 would be a difficult year for markets. Despite this pessimism, the market rose by 26% in 2023, with strong performance continuing year-to-date.

Historically, the stock market has tended to perform well after periods of heightened pessimism. For example, at the peak of bearish sentiment in 2009, the market began a remarkable recovery, leading to the longest bull market in history. On the other hand, low levels of bearish sentiment in 1987 preceded one of the most significant market crashes ever.

The Challenge of Staying Disciplined

Human psychology makes it difficult to resist the pull of market consensus. As social creatures, we are hardwired to be influenced by the prevailing mood. However, maintaining commitment to a disciplined, well-structured investment plan is essential for long-term success.

While it sounds simple to stick to a strategy, it is far from easy. The real challenge lies in resisting emotional reactions and ignoring the noise of short-term market sentiment.

The above article was written and adapted by Marius Kilian.

Sources

* chartoftheday.com/aaii-bears-vs-sp-500?

* edition.cnn.com/markets/fear-and-greed