Personal Financial Planning – Shifting from IQ to EQ

Consumers weigh the perceived value of products and services against the asking price.

Two components affect consumer decisions regarding products and services:

- What am I paying? – Price

- What am I getting? – Value

When you lower prices your profitability goes down. It’s simple. Discounting everybody else that provide a similar product or service will only work if you can create scale or efficiencies. You must do more, provide more, sell more to secure the same amount of income.

Race to the bottom

Over the past decade a lot of attention in financial services has gone into the pricing side. We focus on price because it is easier to understand and manage. Advisors need to do more, assume more risk, deal with more complexity for lower fees. This rings true for everybody in the value chain. Is this a good and sustainable business model? Cheap ≠ Good……even more so not “Best”.

If you want to maintain or increase the pricing, you need to address the value side of the equation. The value side is harder to define and measure. Either you communicate and manage your value more effectively or, alternatively you need to find ways to deliver more value.

What do consumers value?

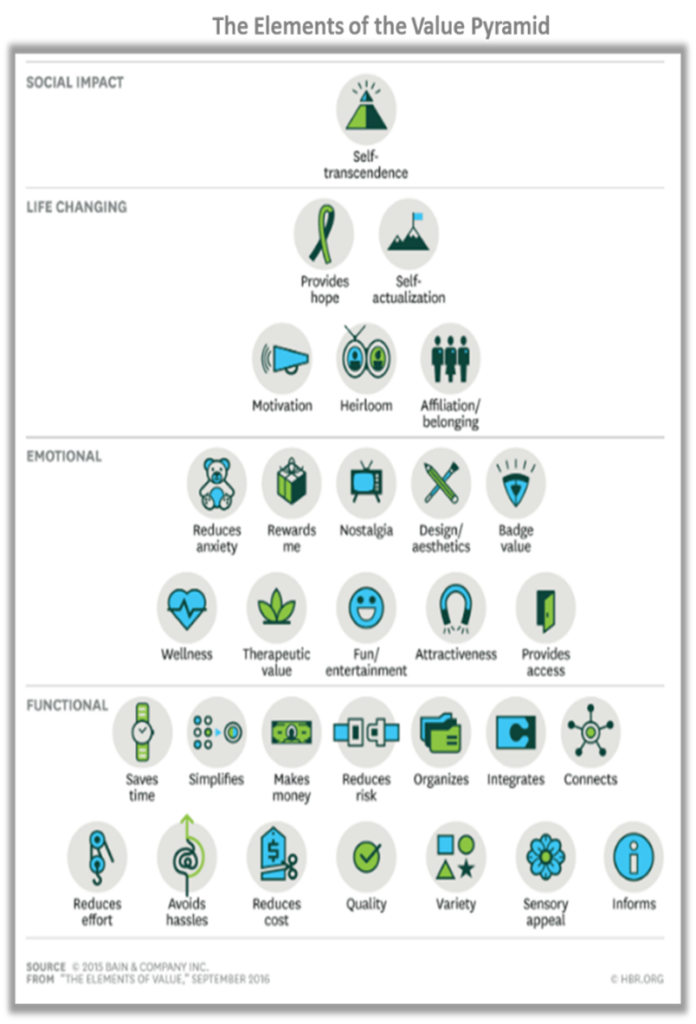

Bain & Company has identified 30 “Elements of Value”. Their research breaks the “elements of value” attributes into discrete forms (universal building blocks) and then divide it into four categories: functional, emotional, life changing, and social impact.

The conceptual roots of the consumer value pyramid are based on Maslow’s hierarchy of needs. The consumer value pyramid is similar to Maslow’s model in that it looks at the motivations that drive the behaviours of people as consumers. They identified, through their research, what the values are that sit behind client preferences.

Products and services deliver fundamental elements of value that address four kinds of needs: functional, emotional, life changing and social impact (set out in the graph above). Understanding what your customers truly value can have big benefits: clearer differentiation, more pricing power and bigger market share. The right combination of values results in stronger customer satisfaction and loyalty. Furthermore, delivering more value accounts for greater market share and revenue growth, according to the research.

The most basic needs are functional. Money Management sits in the functional needs category. Emotional and motivational needs sit higher up in the value stack. Moving up the value hierarchy means that you are shifting traditional financial planning from technical advice to the human side of advice.

How do we deliver greater value to clients?

You need the right combination of value elements.

The functional level elements that simplify, reduces effort, reduces risk, and money management forms the foundation and base of what we do for clients in financial services. You need to do this well. We have experienced an increase in the third-party provider eco-system where advisors intentionally outsource certain elements to free themselves up to be able spend more time with their clients. You cannot outsource empathy (EQ). EQ separates the great advisors from the rest.

Financial planning is shifting from being technical and investment driven to being client centred. Where “Return on Investment” dominated conversations previously there is a clear transition towards a “Return on Life” narrative. The “personal” part of personal financial planning is coming to the fore.

“We want to shift our focus away from dying rich to how do we live richly.” – Joe Duran head of Goldman Sachs Personal Financial Management.

Moving higher on the value pyramid requires EQ and intuition, not a higher IQ. EQ is one’s emotional quotient, whereas IQ scores intelligence. Advisors that moved higher up the value hierarchy have different conversations with their clients. Helping clients to understand the motivation behind their money decisions and avoiding the behavioural mistakes that humans predictably make has greater value than the historic focus on product and performance. The conversation focusses on what the client can actually control and creates an environment to modify emotional responses.

This shift moves the value offering from the “product economy” to the “experience economy”. Products and performance will always be relatively compared and priced. An experience is personal and cannot be relatively priced. It is in the product economy where you will struggle to differentiate your value and be subject to discounting and commoditization.

“I personally believe that the top advisors over the next decade or two will actually be those that have the greatest EQ rather than IQ,” Michael Durbin, Fidelity Institutional president.

Focus on the human side of advice benefits both the client and the advisor.

The above article was written by Marius Kilian.

Sources:

* “The Elements of Value, Measuring—and delivering—what consumers really want”, Eric Almquist, John Senior, and Nicolas Bloch, Harvard Business Review, Sept 2016

* “The 30 Elements of Consumer Value: A Hierarchy”, Martin Luenendonk, Clecerism.com, Feb 2020.