Reasonable Expectations for Equity Investing

Hendrik Bessembinder, a professor at Arizona State University and the author of the groundbreaking paper “Do Stocks Outperform Treasury Bills?” provides key insights into the realities of stock market investing and lifetime wealth creation through the markets.

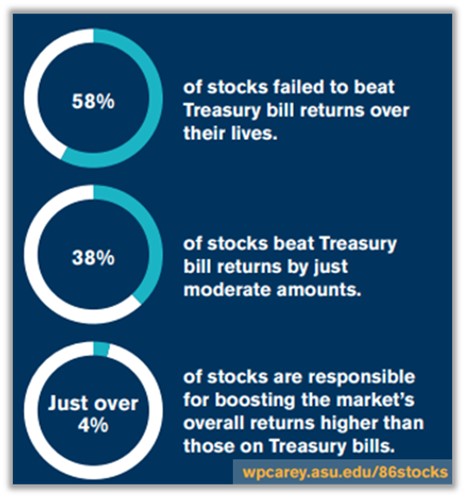

Bessembinder evaluated the lifetime returns of every U.S. common stock traded on the New York and American stock exchanges and the Nasdaq from July 1926 to December 2015. He compared these stock returns with one-month Treasury bills over various periods. Treasury bills are commonly considered a proxy for cash. He found that, individually, not many stocks outperform Treasury bills. Collectively, however, the stock market significantly outperforms bonds and Treasury bills.

He defines net wealth creation as the total stock returns in excess of one-month Treasury bill returns. While the stock market created about $32 trillion in lifetime wealth over this approximately 90-year period, more than half of that came from only 86 top–performing stocks out of nearly 26,000.

Some key findings:

The median stock’s cumulative return was -7,41% (the median is the middle number of a group). There is a big spread between the median and mean return.

In particular, he found that returns from long-term stock investing are positively skewed, meaning that very large returns to a few stocks pull up the average, while most stocks post modest to negative returns. Over the long run, while the total stock market has prospered, most individual stocks have not.

He considered 22 metrics (including valuation and dividends) to analyse the wealth created by companies over 10-year periods going back to 1950. He found that only four stand-out factors had statistical significance:

- Strong cash accumulation.

- Rapid asset growth.

- Higher R&D spending.

- Larger drawdowns in the prior decade.

The average investor typically avoids stocks that had larger drawdowns in the preceding period.

The Challenge of Picking Winners

What if you could pick the one or two stocks that will outperform all others over the next decade?

If only it were that easy.

Investing requires foresight since you cannot profit from hindsight. History suggests that the next top-performing stock will likely be one that is currently not well-known and has experienced significant drawdowns in the prior decade.

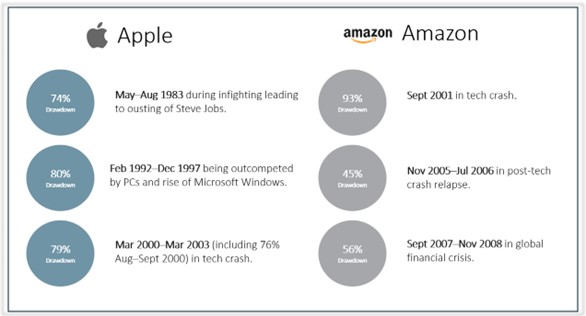

Consider Apple and Amazon.

Anyone who invested in these companies from inception and held through the ups and downs would have done extraordinarily well. However, given the significant drawdowns they experienced individually, it is clear that most investors do not have the stomach for large peak-to-trough share price declines.

Ian Cassel (MicroCapClub) aptly suggests: “Winning blinds you to risk. Losing blinds you to opportunity because you are focused on surviving today.”

The clear takeaway from this research is that investors should be broadly diversified. The endeavour of making predictions and picking “winners” is a loser’s game.

Experiencing gut-wrenching drawdowns over the lifetime of an investment should be expected. It is unreasonable to anticipate that your investments will always perform well and outperform the market.

Expectations

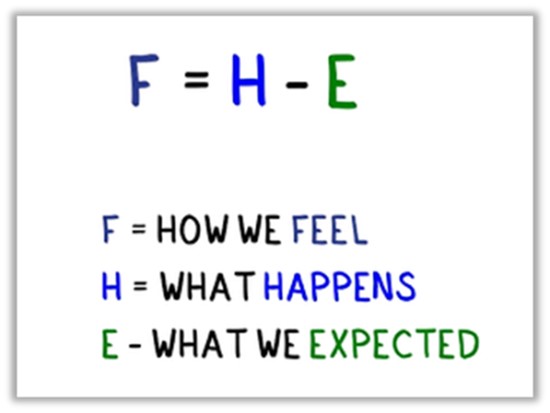

Our experience of reality is shaped by our expectations.

The little equation below, proposed by Derek Hagen, says that how we feel is what happened minus what we thought would happen (or happiness equals reality minus expectations).

This is an important concept. Expectations matter.

Your experience of any event is determined by your expectations, which directly impacts your behaviour. Stock market downturns will recur in the future, although we don’t know when or for how long they will persist.

It is therefore paramount to set reasonable expectations informed by a clear understanding of reality.

If not, investors will be motivated to abandon thoughtful investment strategies while staying the course would have been the desired behaviour.

The above article was written and adapted by Marius Kilian.

Sources

*“Do Stocks Outperform Treasury bills”? Hendrik Bessembinder, W.P Carey School of Business, 3 Jun 2018

*“Hot Stocks Can Make You Rich. But They Probably Won’t.”, Jeff Sommer, nytimes.com, 12 May 2017

*“Lessons from Bessembinder,” Tim Alcorn, magazinebailliegifford.com

*“Understanding Life Transitions”, Derek Hagen, meaningfulmoney.com, 11 Jul 2024