The Familiar Tale of Investment Folly

We find ourselves trapped in an all-too-familiar plot, witnessing a recurring phenomenon where investors fall prey to chasing outsize returns, only to be left disappointed and burnt. The ARK Innovation ETF, once the largest actively traded ETF, serves as our protagonist in this narrative. Its meteoric rise during the COVID-induced market surge in 2021 and subsequent downfall following the Fed’s rate hikes in 2022 echo a tale that has unfolded in the investment world time and time again.

The Rise and Fall of ARK Innovation ETF

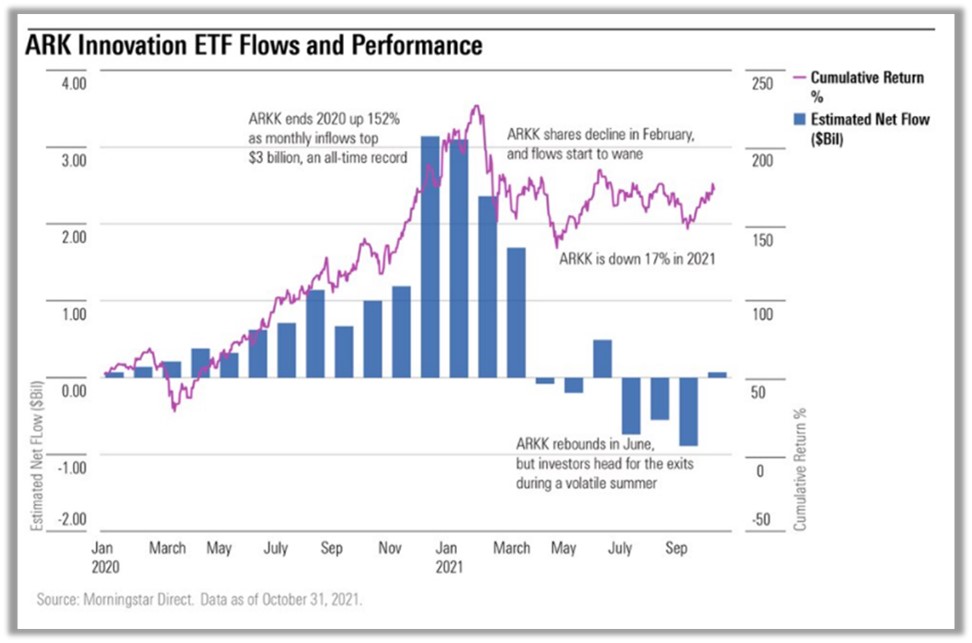

In 2021, the ARK Innovation ETF experienced a surge in popularity, attracting an impressive $6.5 billion in first-quarter inflows, with its share price reaching a peak. Investors were lured by the promise of extraordinary returns during uncertain times. This followed a return of +152,82% for the year in 2020.

In 2021, the ARK Innovation ETF experienced a surge in popularity, attracting an impressive $6.5 billion in first-quarter inflows, with its share price reaching a peak. Investors were lured by the promise of extraordinary returns during uncertain times. This followed a return of +152,82% for the year in 2020.

However, this euphoria was short-lived, and in 2022, the fund plummeted by a staggering 67% when the Federal Reserve commenced its rate hikes. Presently, the fund trades at approximately 70% below its all-time high. Most investors did not participate in the great run of 2020 but did experience the draw down in 2021 and 2022. The fund had negative flows from around mid-2021 when performance went soft.

Missed Opportunities and Subsequent Rally

Regrettably, the ARK Innovation ETF missed out on seizing an opportunity with Nvidia, a standout performer in the S&P 500. Having sold their holdings in Nvidia in January 2023, the fund watched as the stock tripled in value, further adding to investors’ disillusionment. Nonetheless, the fund has rallied over 50% this year, a silver lining that provides some respite to its stakeholders.

The Bittersweet Reality of Annualized Returns

Since its inception in 2014, the ARK Innovation ETF has achieved an 11% annualized USD return, a figure that may initially appear appealing. However, for the average investor, the story is quite different, as they have experienced a -21% annualized dollar-weighted return.

This discrepancy highlights a prevalent phenomenon where investors often mistime their cash flows, investing when the fund boasts stellar performance and typically exiting when it struggles. This story is still unfolding.

Understanding Investor Behaviour

A wealth of research supports the notion that investors typically underperform the annualized returns of the funds they invest in. Rather than bucking the trend, fund flows are often driven by recent performance.

As we have discussed previously in a previous article (www.2ip.co.za/chasing-the-heat-gets-you-burned), this cycle of investor behaviour seems to persist, despite repeated warnings and cautionary tales.

Conclusion

In this ever-repeating movie of investment folly, the ARK Innovation ETF stands as just one example of a cycle we encounter all too frequently. The plot remains unaltered – investors, driven by the pursuit of extraordinary gains, often find themselves disillusioned when the reality falls short of their expectations.

Let us take heed of history’s lessons and resist the allure of chasing recent performance, instead making informed and rational investment decisions.

Only then can we hope to escape this recurring tale and write a new script for our financial journeys.

The above article was written and adapted by Marius Kilian.

Source

*“Investors Are Bailing on Cathie Wood’s Popular ARK Fund”, Jack Pitcher, The Wall Street Journal, 16 July 2023.

*www.morningstar.com/etfs/arcx/arkk/performance