The Surprises From the First Half of 2023

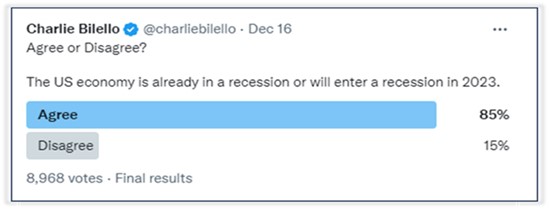

In a recent blog the insightful Charlie Bilello highlighted some of the surprises for the first half of 2023. A tough 2022 wore investors down and consensus sentiment turned very bullish.

The recession that never came

In December 2022, there was widespread agreement that the U.S. economy was either already in a recession or headed for one in 2023. From an inverted yield curve and rapidly rising interest rates to historic lows in consumer sentiment, everybody seemed to be calling for an imminent recession and falling stock prices.

However. The first quarter of 2023 saw positive growth in real GDP (US), and it is likely that this will also be the case for the second quarter. The anticipated recession has not yet materialised, surprising many market participants.

However. The first quarter of 2023 saw positive growth in real GDP (US), and it is likely that this will also be the case for the second quarter. The anticipated recession has not yet materialised, surprising many market participants.

Investor Pessimism

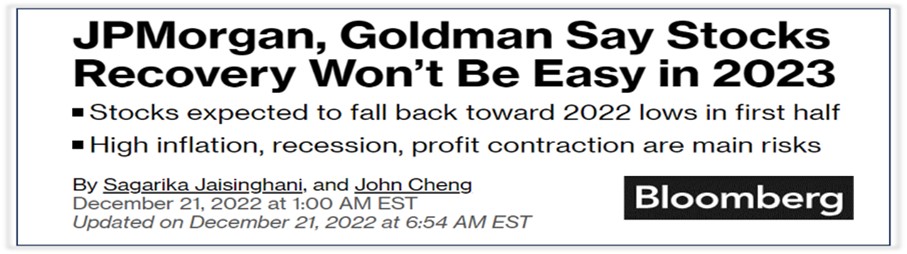

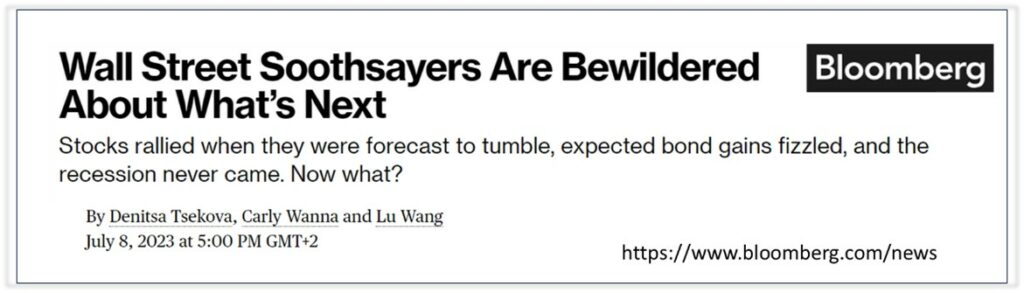

For the first time in decades, Wall Street strategists predicted a down year for stocks in 2023. As the latter part of 2022 approached, investor pessimism prevailed, leading to significant outflows from markets and a shift towards cash. Headlines on Bloomberg and other major publications were predicting a dire start to the markets in 2023.

Finding commentary that was not saturated with doom and gloom was a challenge. This negative messaging influenced the decision-making of many investors who still rely on daily news flow and strong opinions. Sensational news often evokes emotions that can cloud judgment.

Finding commentary that was not saturated with doom and gloom was a challenge. This negative messaging influenced the decision-making of many investors who still rely on daily news flow and strong opinions. Sensational news often evokes emotions that can cloud judgment.

A run on the banks

While the S&P 500’s returns this year may not reflect it, there was a mini-panic in the banking sector, resulting in the second, third, and fourth largest retail bank failures in U.S. history.

Just two weeks before the Silicon Valley Bank crisis unfolded, a local investment conference discussed major risk factors for 2023 at length, but a possible banking crisis in the USA was never mentioned.

Predictably, the narrative changed once the news broke, and investors braced themselves for the worst.

Against this backdrop, it is understandable that investors were preparing for a difficult period. However, the actual outcomes defied expectations.

What was expected did not happen……

Surprisingly, 2023 has seen one of the best starts for the S&P 500 in history, with a 15.9% increase. It represents the 13th best first-half yearly performance on record since 1928. Unlike 2022, nearly all major asset classes have experienced upward movement. In the 2000’s so far, only 2019 provided a better first-half year return at 17.3%.

“There was no shortage of things for investors to worry about in 2022, but those who stuck with or added to portfolios were rewarded with one of the best first halves on record.” – Charlie Bilello

Nobody can predict the markets with consistent accuracy.

Having a well-articulated investment plan and sticking to it has historically been the wiser choice. Getting caught up in the incessant news flow and the desire to know the future has proven to be costly, leading to poor judgement and unnecessary emotional roller coasters.

What will happen in the next 6 months?

We don’t know.

If we have a sound strategy based on solid investment principals, all we need to do is to behave accordingly. Time and patience will reward us through the process of compounding. Over the long term our behaviour is the predictor of success or failure.

In the short-term the markets will always surprise us.

The above article was written and adapted by Marius Kilian.

Source

*”10 Surprises From the First Half of 2023”, Charlie Bilello, charlie@bilello.blog, 8 July 2023

* Bloomberg.com